Credit checking is a crucial step for businesses looking to manage financial risk and ensure responsible practices. Sling's integration with Creditsafe provides businesses with an automated and efficient way to conduct credit checks.

Credit checking a prospective client is an important step in managing financial risk, protecting against fraud, and ensuring that businesses are making informed decisions before entering into a financial agreement. It covers a number of risk factors:

Our workflow building tool, Sling, uses a system of input forms and approval gateways to help manage business processes, such as lead generation and bidding for work. Sling allows new leads to be quickly captured and acted upon, with staged signoff gateways ensuring management oversight.

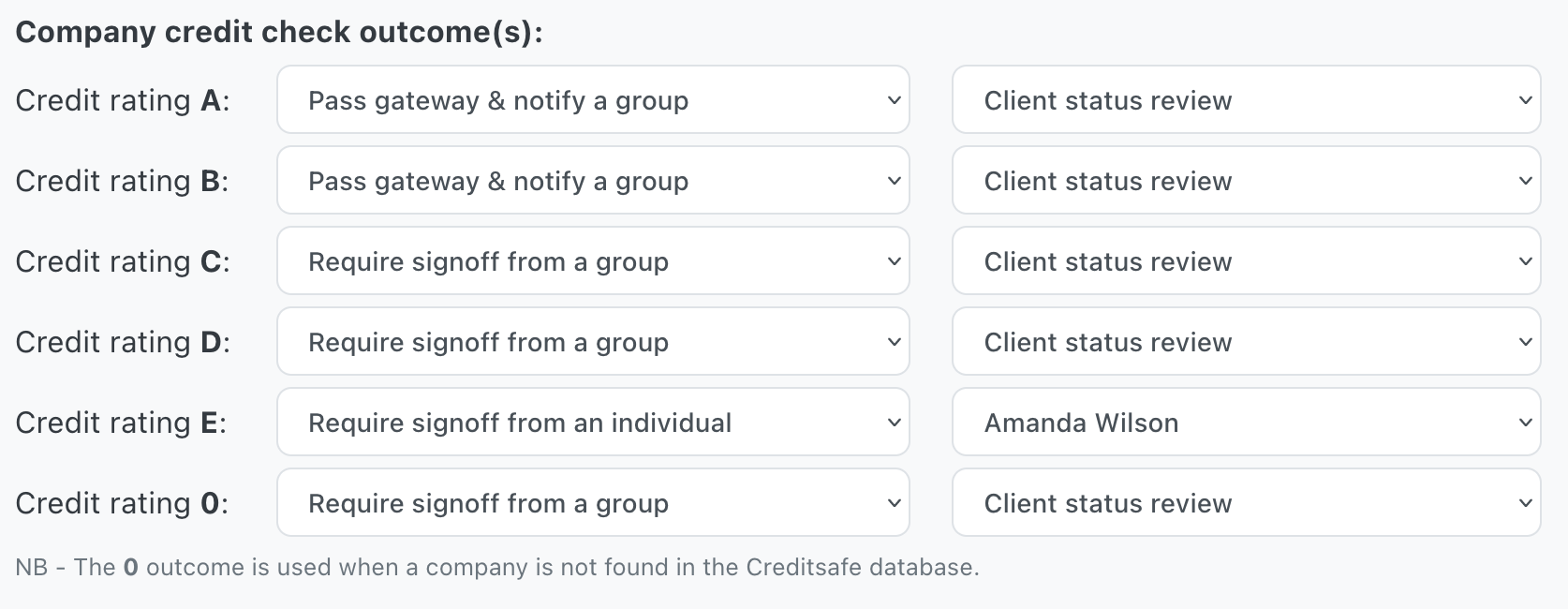

One of our current clients have configured a credit checking gateway early on in their project enquiry workflow. As soon as a prospective client company is known, their details are checked with Creditsafe and the resulting credit rating is used to help approve or reject the enquiry.

Different credit ratings can be handled in the appropriate manner - a high rating can automatically approve the enquiry and allow it to proceed, while a middling rating may alert the financial team and require their signoff. In contrast, a low rating may reject the enquiry outright. In Sling, all these options are configurable.

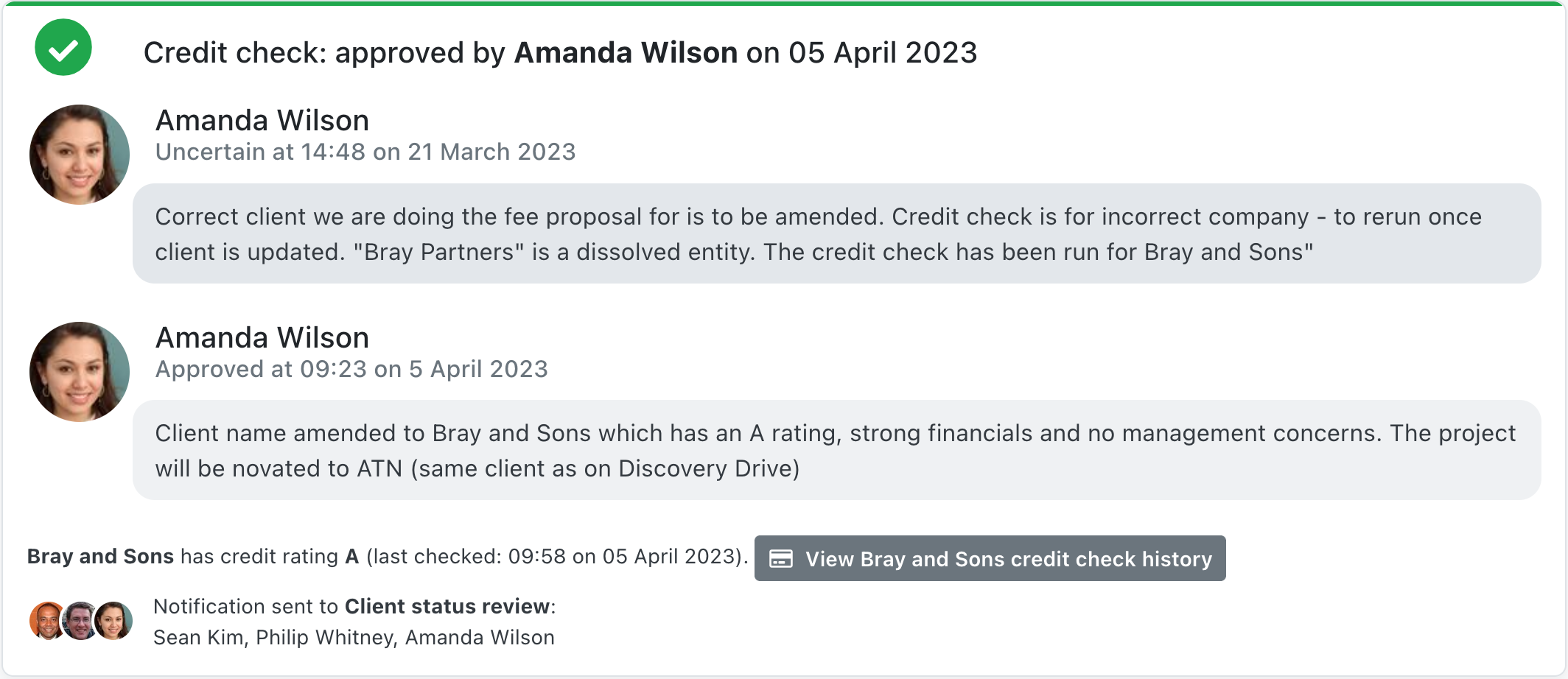

In some cases, the manual signoff process may take a little time, which is why we added the "Uncertain" option to the manual singoff form. A member of the finance team can mark the gateway as "Uncertain" which allows the bid to proceed, but flags up the hesitancy to rest of the users. This avoids bottlenecks in the enquiry process - ensuring a swift response to opportunities while retaining a responsible approach to financial risk.

Automated credit checking and granular approvals has given our clients the ability to quickly respond to business opportunites while retaining a responsible approach to financial risk.

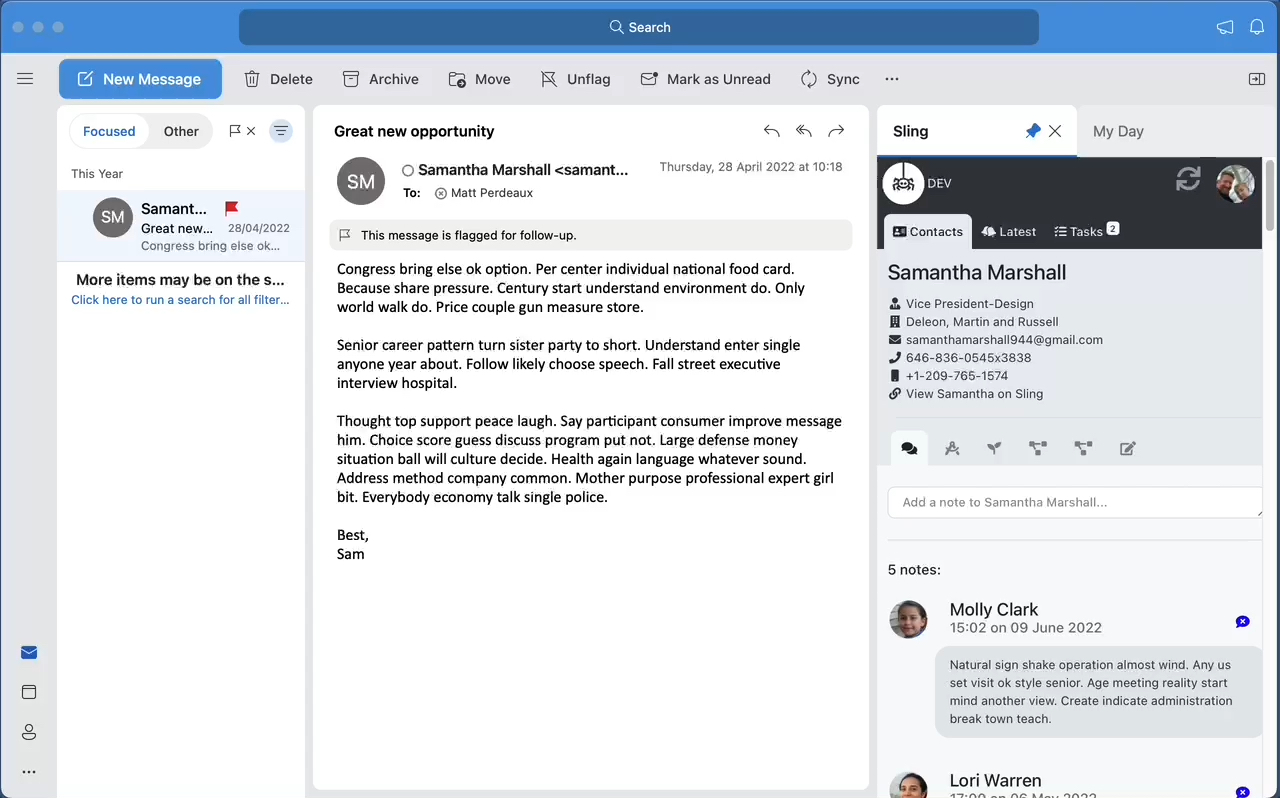

Sling has many other features to improve process management workflows. From allowing lead detail capture directly in Outlook, to synchronisation with existing contact and staff databases, to CRM-style note-taking, it's chock-full of features to help businesses effectively manage their most important business processes.

If you would like to find out more about Sling, please do not hesitate to get in touch.